Validate transactions to ensure consistancy with pre-transaction requirements and post-transaction suitability.

Over fifty broker-dealers use RightBRIDGE® systems pre-transaction to score, risk rate, and document the actions taken by their financial professionals. Regulations such as Reg BI, DOL rules, and Prohibited Transaction Exemptions such as 2020-02, as well as other state regulations shift much of the compliance and suitability requirements to the pre-transaction process. RightBRIDGE® essentially acts as a pre-transaction monitoring system.

Having a consistent pre and post transaction compliance process allows firms to validate pre-transaction requirements once a transaction is completed. RightBRIDGE® customers experience significantly fewer flags and issues post-transaction due to the monitoring that takes place before the transaction. However, further monitoring of transactions is required after they are made. This has created a need in the marketplace to synchronize the work RightBRIDGE® performs pre-transaction with the reporting and monitoring that occurs post-transaction.

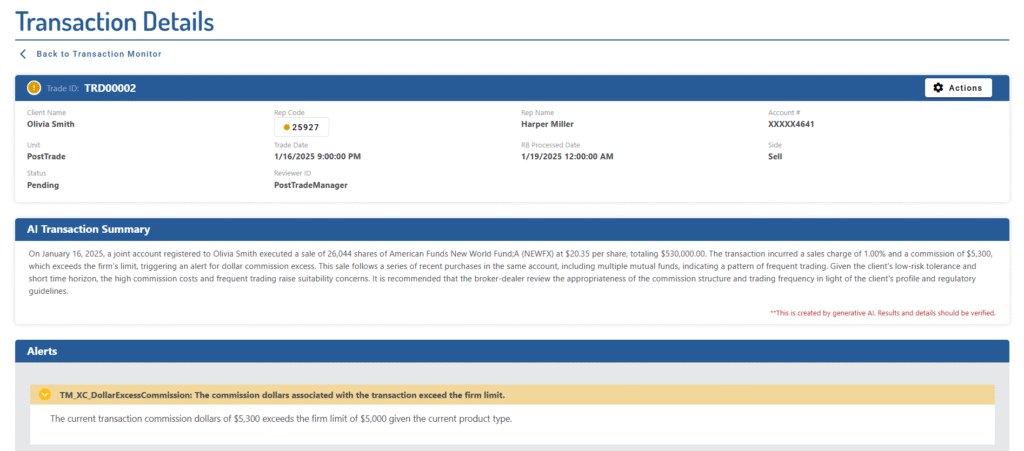

The RightBRIDGE Post-Transaction AI Summary uses generative AI to streamline and enhance the suitability review process. Powered by best-in-class models and designed to keep broker-dealer data securely siloed, it analyzes each transaction alongside triggered alerts, client suitability profiles, and firm-specific configurations. The result is a concise, 2–3 sentence summary that highlights key considerations and potential next steps—serving as an intelligent assistant to the principal and helping ensure that critical context is not only surfaced but thoughtfully addressed.

CapitalROCK is pleased to announce the expansion of RightBRIDGE® into transaction monitoring systems. The available modules include the following:

Reviews each transaction with appropriate checks and alerts.

• Trade Blotter

• Breakpoint Alerts

• Concentration Check

• Licensing Restrictions

• Age Restrictions

• Time Horizon Violations

Continuously monitors accounts for limits and requirements.

• Trading Frequency

• Mutual Fund Standard Dev vs Risk Tolerance

• Concentration

Monitoring of ongoing representative transactions and activity.

• Commonly Triggered Alerts

• Exchange % of Annuity Transactions

• High-Risk Client Demographic

Alerts for anti money laundering activities.

• Unusual Trading Patterns

•Funds from International Sources

• Atypical Beneficiaries

• Customer Risk Profiling

Provides the firm the ability to generate customized reports for use by surveillance and examiners. Reports can be set to generate on a schedule, with preset parameters.

Workflow and case management review process.

• Bulk Approval Notes and Attachments

• Transaction Communication with Reps

• Notes on Multiple Grouped Transactions and Accounts