INVESTMENT WIZARD®

Platform & Portfolio Recommendation Validation

Investment Wizard® is the leading pre-trade compliance solution for firms looking to meet the needs of Regulation Best Interest (Reg BI) and PTE 2020-02 for platform, portfolio, and investment-level recommendations. The application features a dynamic questionnaire to capture a client’s profile, firm-configured best interest and suitability checks, automated documentation of why a recommendation may be in the best interest of a client.

Investment Wizard® covers a wide variety of product types, including mutual funds, ETFs, UITs, 529 plans and portfolios, illiquid alternative investments, structured products, ABLE accounts, and all types of investment platforms.

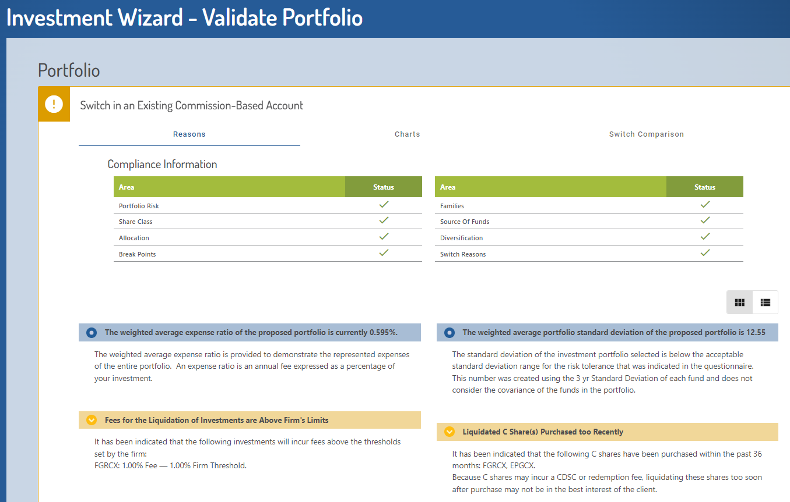

Best Interest & Suitability Review and Documentation

Analyze platform-level and portfolio-level recommendations made to clients to ensure that a recommendation is in their best interest! The Investment Wizard® utilizes a customer’s profile and firm-configured compliance checks (such as share class, breakpoint, and concentration checks) to document and ensure that recommendations are in the best interest of the client.

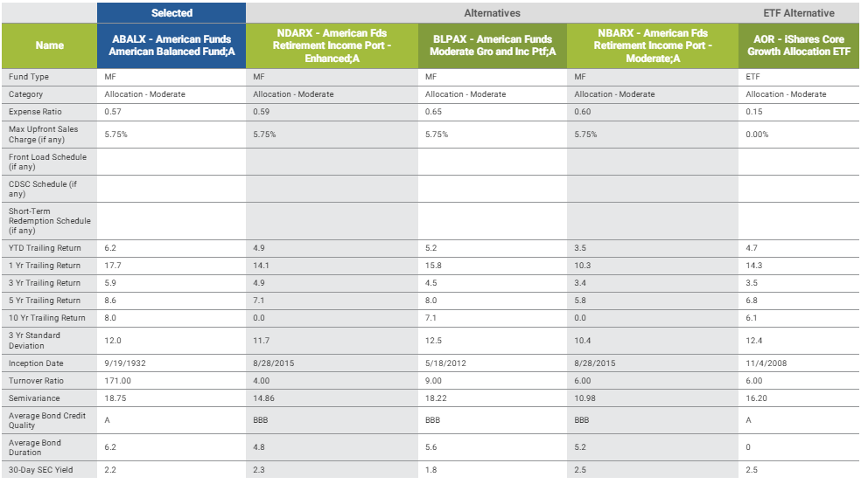

Reasonably Available Alternatives

Investment Wizard® assists financial professionals by presenting high-quality reasonably available alternatives in a side-by-side comparison to investments that have been recommended to the client. The application selects low-cost and low-risk reasonably available alternatives that are available to the customer within the firm and allows for the financial professional to switch the recommendation based off of the reasonably available alternatives presented.

Investment Research Tool

Compare investments across all your platforms in one consolidated side-by-side table! The investment research tool allows for financial professionals to see product shelves for all available platforms available to the firm in one convenient location and compare the investments on over 25 datapoints, with the ability to sort, filter, and print side-by-side investment comparison reports.

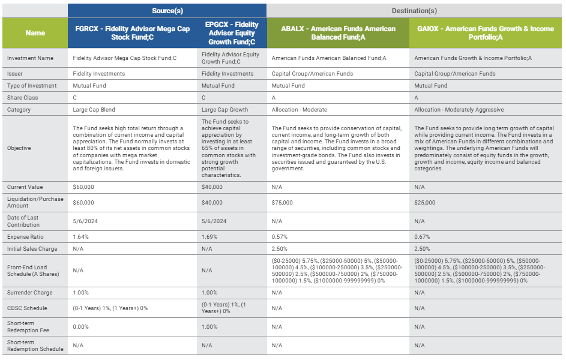

Mutual Fund Switch Form Replacement

Don’t miss out – many firms have begun eliminating their firm’s manual mutual fund switch reports with RightBRIDGE’s® automated mutual fund switch report. This new customizable report allows for firms to perform firm-specific mutual fund switch checks and present the source and destination mutual funds in a side-by-side comparison, including details about the mutual funds and fees associated with the liquidation and purchase.

FEATURES

Fund Selection and Pre-Sale Best Interest Validation

Utilize the Investment Wizard® to speed up and consolidate your firm’s compliance requirements for financial professionals.

Reasonably Available Alternatives

Automatically generate high-quality Reasonably Available Alternatives for investments recommended to your clients.

Best Interest Checks and Automated Documentation

Ensure and document best interest for recommendations made to clients

Mutual Fund Switch Form Replacement

Replace manual mutual fund switch forms with RightBRIDGE’s automated mutual fund switch form, including firm-configured liquidation checks and a side-by-side comparison of source and destination mutual funds and fees related to the switch.

Investment Research Tool

Compare investments across all platforms available at your firm in one easy-to-use grid. Sort, filter, and compare on over 25 datapoints and generate a printable side-by-side report of user-selected investments.

Capturing of fees related to a recommendation

Capture fees associated with recommended purchases or liquidations.

Portfolio Checks and Breakpoint Analysis

Check the recommendation against firm-configured share class, concentration, and breakpoint checks by leveraging the customer’s existing holdings.