RIGHTBRIDGE® FOR REGULATION

Reasonably Available Alternatives and RightBRIDGE®

Along with the results based on your client’s needs, RightBRIDGE® provides alternative solutions

Consistent Process and Output

Consistent Process and Output

RightBRIDGE® systems provide repeatable and predictable outcomes for compliance purposes. The Reasonably Available Alternatives (“RAA”) feature helps speed up the financial professional’s process by ensuring that the alternatives considered are not only available at the rep’s firm but are similar in nature to the selected product. The broker-dealer is able to adjust the factors and their weightings that are used to score the alternatives. This puts the Reasonably Available Alternatives process on rails and prevents reps from having to make notes by hand which can lead to inconsistencies from rep to rep.

RightBRIDGE® uses its powerful rules engine to help identify Reasonably Available Alternatives at both the Product Category Type (Brokerage versus Advisory, Mutual fund account vs VA with Living Benefit etc.) and the individual product type.

Reasonably Available Alternatives for Product Categories

Reasonably Available Alternatives for Product Categories

At the product category level, the Product Profiler® provides RAA in the form of different product categories that are available at the broker-dealer. At the beginning of this process the financial professional identifies their suggested product type and then completes the client profile. RightBRIDGE® then uses the client profile to determine if the user selected product type meets the broker- dealer’s best interest requirements. RightBRIDGE® will use the very same client profile data to rank and score other available product types. This helps financial professionals evaluate whether their selection was appropriate and helps document their Reasonably Available Alternatives.

Mutual Funds, ETFs and UITs

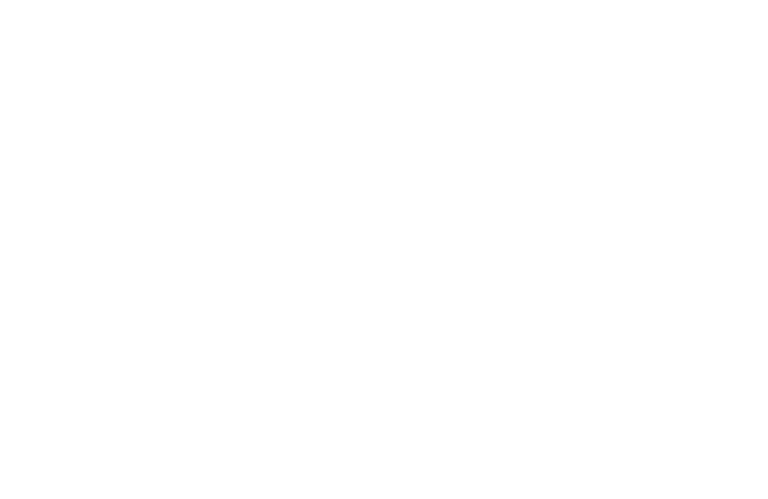

RightBRIDGE® provides Reasonably Available Alternatives from the broker-dealer’s list of actively sold funds. Funds that are in the same category as the fund that has been selected by the financial professional are considered. RightBRIDGE® identifies Reasonably Available Alternatives by performing a 3-part comparison of the peer funds by using the Reward to Risk Ratio, Expense Ratio, and Peer Performance.

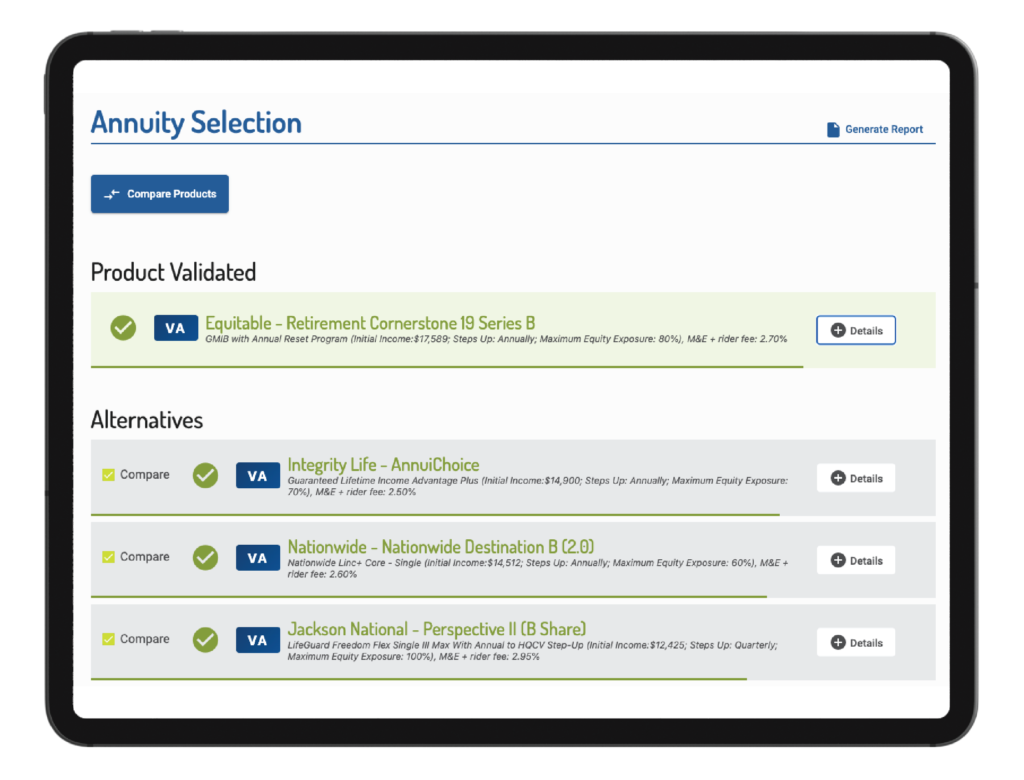

Annuities

RightBRIDGE® provides Reasonably Available Alternatives from the broker-dealer’s list of actively sold funds. Funds that are in the same category as the fund that has been selected by the financial professional are considered. RightBRIDGE® identifies Reasonably Available Alternatives by performing a 3-part comparison of the peer funds by using the Reward to Risk Ratio, Expense Ratio, and Peer Performance.

ReasonText®

At the core of all RightBRIDGE® systems is ReasonText®. ReasonText® is automatically generated text that provides financial professionals with an easy way to “show their work”. ReasonText® within the RAA Functionality will notate why the specific Reasonably Available Alternatives were appropriate peer products for the financial professional’s recommendation. This helps avoid the pitfalls of generalized statements like, “…looked at other funds” or “other annuities were considered”, that compliance personnel may find to be inadequate.

Reports

RightBRIDGE® output is made available in PDF form. Reports can be printed, saved locally, or can even be sent via integration to the broker-dealer’s system of record. The selected product and the alternatives are listed side by side in a table for comparison. Users also have the option of including a summary for each product that gives a deeper vision into the characteristics of the product.