PRODUCT PROFILER™

Rollover and Account Type Recommendation Validation

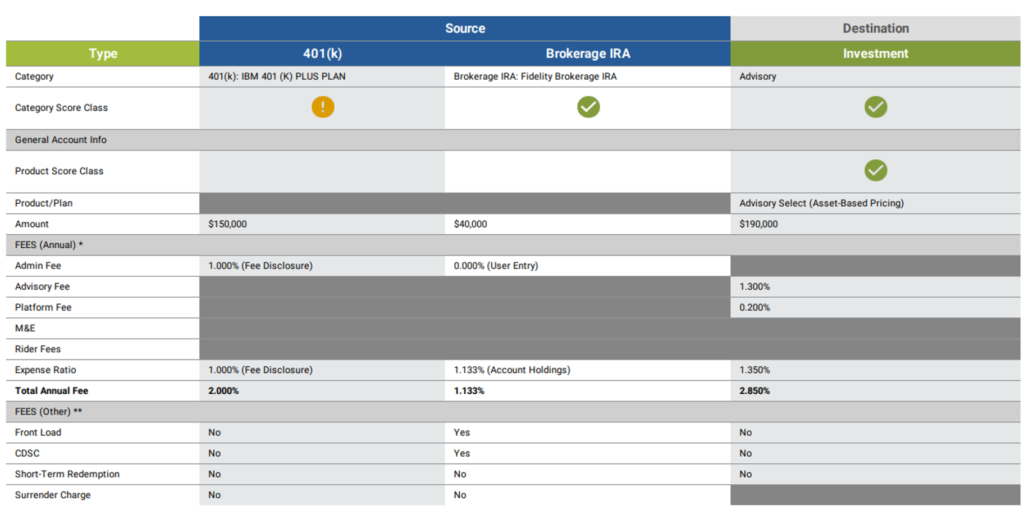

Product Profiler™ uses client data and compliance-approved scoring parameters to validate that a rollover transaction is in the best interest of the client. The source of funds (ERISA rollover, IRA transfer, non-qualified assets) and the destination account/product category are independently analyzed. The output is a comprehensive report that summarizes the reasons for the rollover, compares the fees, and validates that a transaction meets a financial institution’s standards for compliance with best interest regulations.

Show Your Work

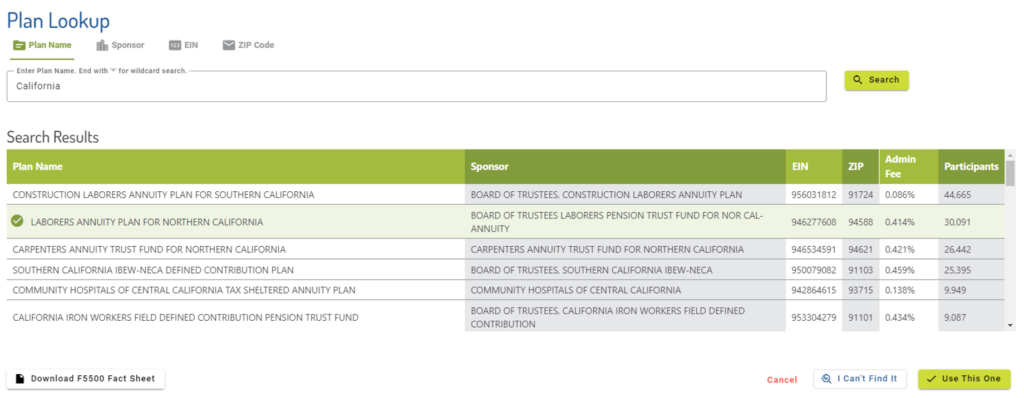

Form 5500 Retirement Plan Lookup

Plan fees, features, and other insights are automatically populated into the questionnaire with a simple lookup. The user can choose to download a factsheet or populate the plan data into the questionnaire.

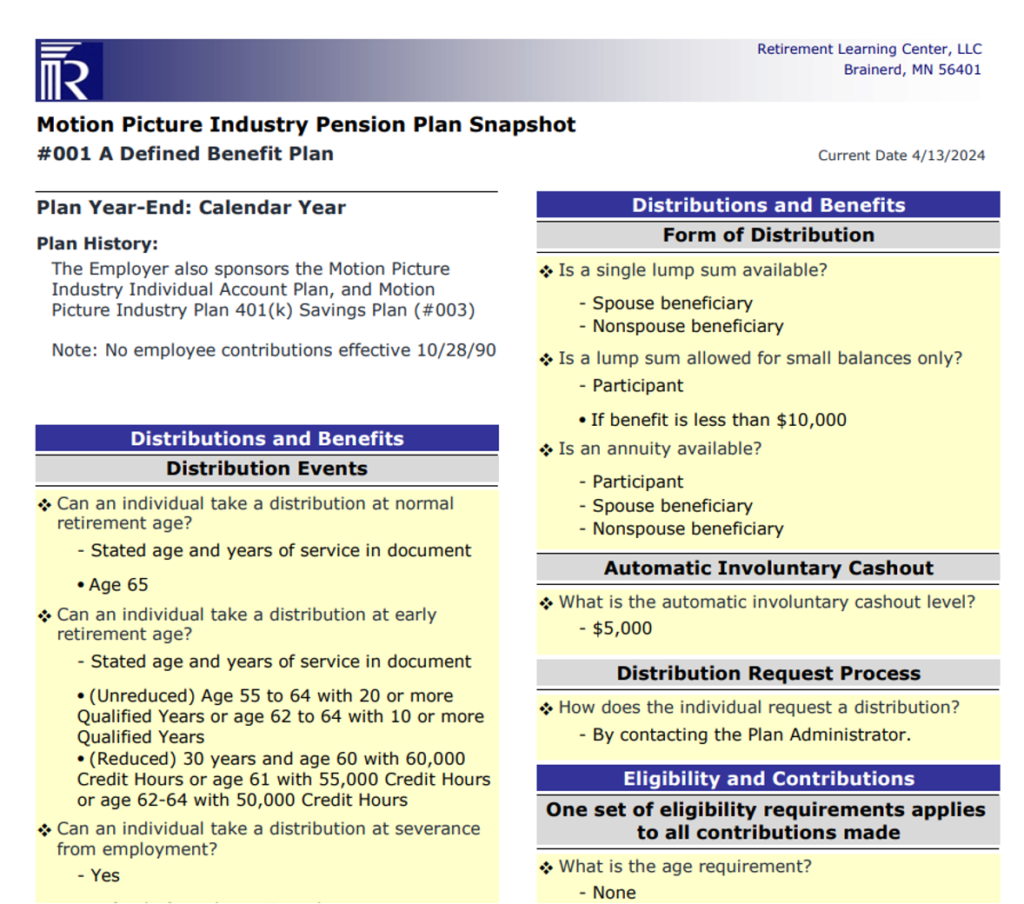

Retirement Learning Center Plan Data Integration

Retirment Learning Center provides best-in-class retirement plan data, derived from actual plan documents for over 4,000 retirement plans, representing over 80% of all ERISA plan participants. This private data source includes data points that are not otherwise accessible from public sources, such as vesting schedules, in-service distribution availability, and the existence of a sponsor subsidy for plan administration fees. These details are automatically populated into the RightBRIDGE workflow, saving time and increasing accuracy.

Replace Firm Switch/Best Interest Forms

Many of our partner firms have been able to use Product Profiler™ to eliminate forms and reduce the burden placed on financial professionals. Product Profiler™ leverages multiple data sources to help the financial professional populate the form with accurate and consistent data.

Analysis of all Rollover Alternatives

The Department of Labor and the SEC both require a consideration of all possible actions with plan assets. The financial professional must provide evidence that they’ve considered not only the option to roll to an IRA, but also the potential to leave assets in the current plan, roll to an in-service plan, or perform a taxable withdrawal. RightBRIDGE analyzes all four of these options and provides supporting ReasonText for each.

FEATURES

Take the Pain Out of Documentation

Product Profiler™ can streamline multiple disparate processes and simplify what is required of a financial professional to stay in-bounds of their firm’s best interest requirements.

Reasonably Available Alternatives Analysis

Allows validation of funding sources and account type destination.

Switch/Transfer Form

Replace your organization’s various replacement forms with RightBRIDGE’s® dynamic workflow and data capture.

All Funding Sources

Validate the source of funds, regardless of tax status or account type. Including: Qualified Plan, IRAs, Non-Qualified Accounts, 529’s, Annuities and Cash equivalents

Smart Questionniare

The Product Profiler™ uses a smart questionnaire that ensures that only relevant and critical questions are collected.

Wizard Integration

Full integration with all RightBRIDGE product Wizards in a single unified workflow

Guaranteed Income Validation

Is the customers future more secure with guaranteed income? The Product Profiler™ provides an analysis that can help.