Annuity Wizard offers a comprehensive annuity exchange comparison designed to meet regulatory requirements and accelerate the principal review process.

The RightBRIDGE® Annuity Wizard provides a comprehensive process for annuity exchange transactions, incorporating in-force policy data through DTCC, complemented by historical data sourced from Beacon Research. With a focus on FINRA Rule 2330 and Regulation Best Interest mandates, Annuity Wizard analyzes key factors, including product and rider fees, surrender charges, rider features, and investment objectives, to help facilitate thorough and accurate recommendations. RightBRIDGE® generates a comprehensive exchange report, effectively replacing traditional forms. Through tight integrations with key platforms RightBRIDGE® is transformed into a complete end-to-end solution.

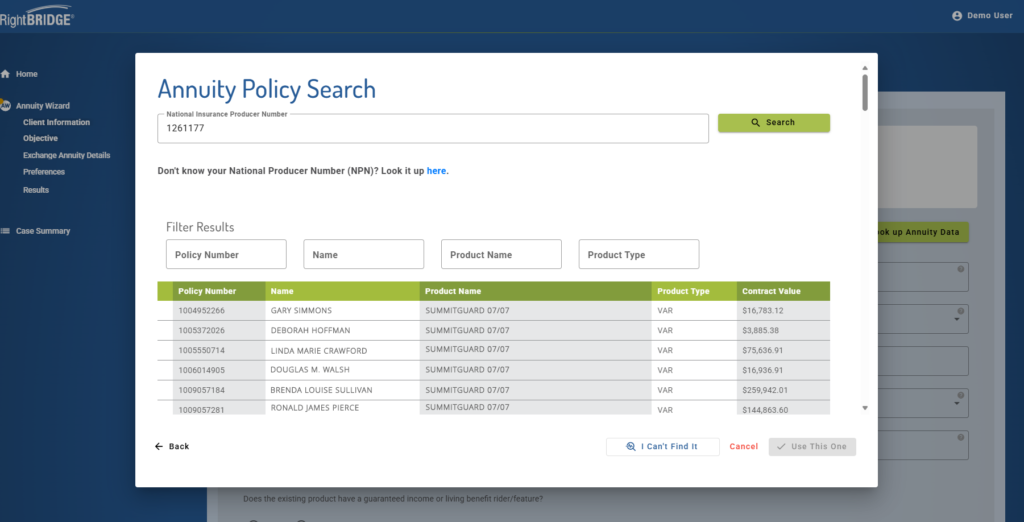

Address the risks associated with manual data entry by leveraging RightBRIDGE’s integration with DTCC, that allows direct access to verified in-force policy information. This is further augmented by comprehensive historical data from Beacon Research to create a one-click experience when filling out an exchange form. When the final report is presented to a client or reviewer, the policy data source is validated, providing a robust and reliable foundation for exchange analysis. Firms can have increased confidence in the accuracy of annuity comparisons, reducing the potential for policy discrepancies.

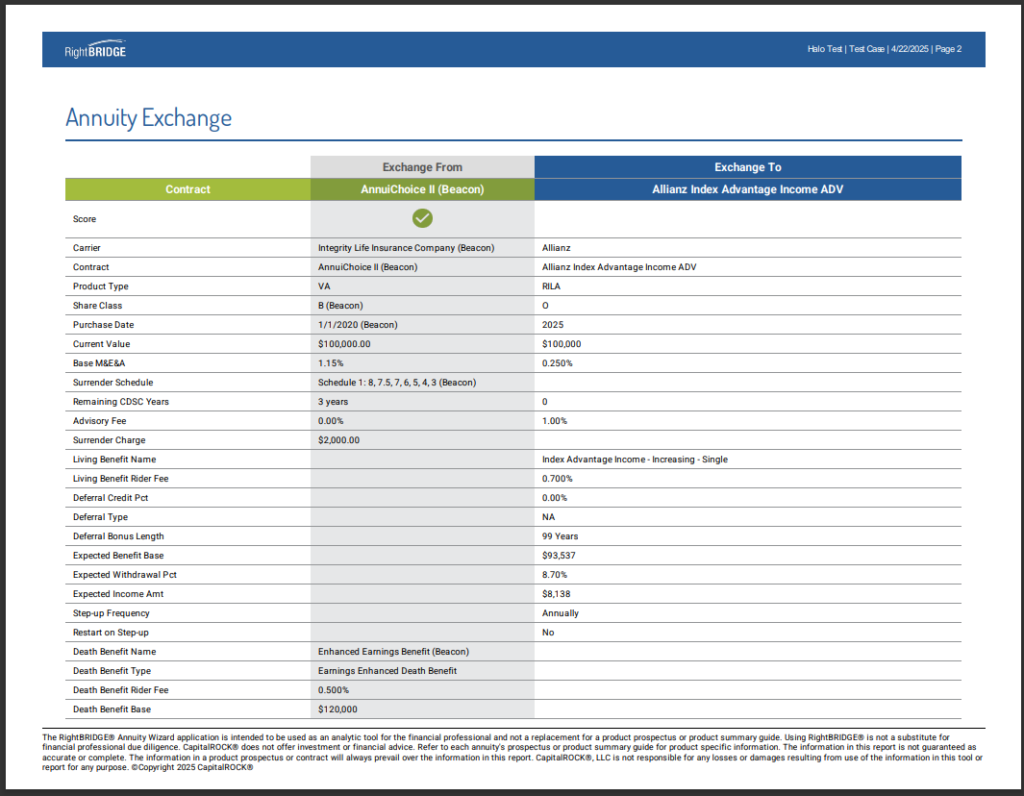

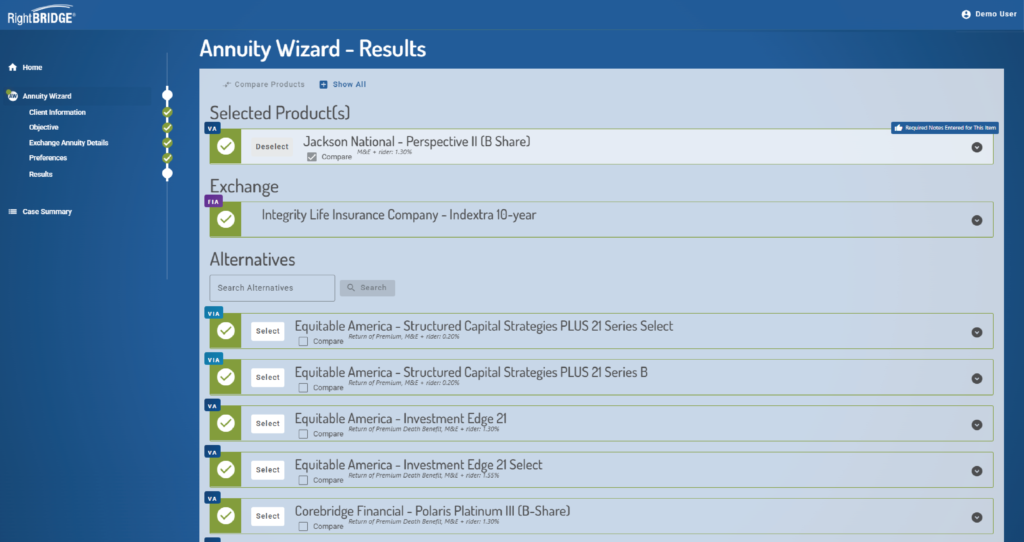

Navigate the complexities of living and death benefit features with RightBRIDGE’s intuitive comparative analysis. Facilitate a clear and concise evaluation of critical elements such as associated fees, income stream comparisons, and potential benefit base loss. An analysis of each annuitant’s investment objective – whether it’s primarily income generation, accumulation or growth, or enhanced death benefits – empowers advisors to formulate clear recommendations that match client objectives and regulatory requirements.

Exercise greater control over the annuity exchange review process by implementing RightBRIDGE’s configurable rules-based engine. Configure the platform to align with your firm’s specific compliance procedures by establishing defined parameters for surrender charge thresholds, benefit base loss, and income stream differentials between existing and recommended products. This functionality promotes the consistent application of your firm’s policies across all annuity recommendations, optimizing the review process and reinforcing adherence to regulatory best practices.

RightBRIDGE® offers seamless integrations with industry-leading order entry platforms Firelight and iPipeline. Data generated within Annuity Wizard is directly transferable to these order entry systems, facilitating a streamlined experience for financial professionals and minimizing duplicative data entry. The platform ensures direct mapping of product data to the corresponding fields within order entry systems, maintaining data integrity and accuracy. With the addition of a front-end integration RightBRIDGE® enables an end-to-end solution for efficient data flow throughout the annuity exchange process.