Unify scattered policy data and surface compliant opportunities your firm can act on today.

RightBRIDGE® Annuity Book Management is a review tool that enables firms, business units, and producers to search, sort, and filter policies, creating an integrated, organized approach to reviewing annuities. Annuity Book Management utilizes the RightBRIDGE® engine that reviews policies and flags review opportunities or policies that may need review. The flags are configurable rules that address business, compliance and suitability concerns as well as annuity business opportunities.

Annuity Book Management supports an API integration into other RightBRIDGE® modules (Product Profiler® and RightBRIDGE® Annuity Wizard) to create a solution for loading needed and available information on in force annuities to accommodate source of funds data capture or annuity replacements.

• The RightBRIDGE® rules engine can power highly customizable alerts including ReasonText® (automated notes about that alert/opportunity) based on available data.

• Annuity Book Management, supports an inforce policy integration with RightBRIDGE’s Product Profiler and Annuity Wizard to support rollover and annuity replacement analysis. It provides users a “one click experience” to create the necessary RightBRIDGE® Annuity Wizard case.

• DTCC PVF position files are required for loading the entire book of business. DTCC IIEX API is an option for a most current update when reviewing a specific policy between entire book loads.

• Roadmap Item and Premium Feature: AI summaries on inforce contract to easily summarize the policy for a user

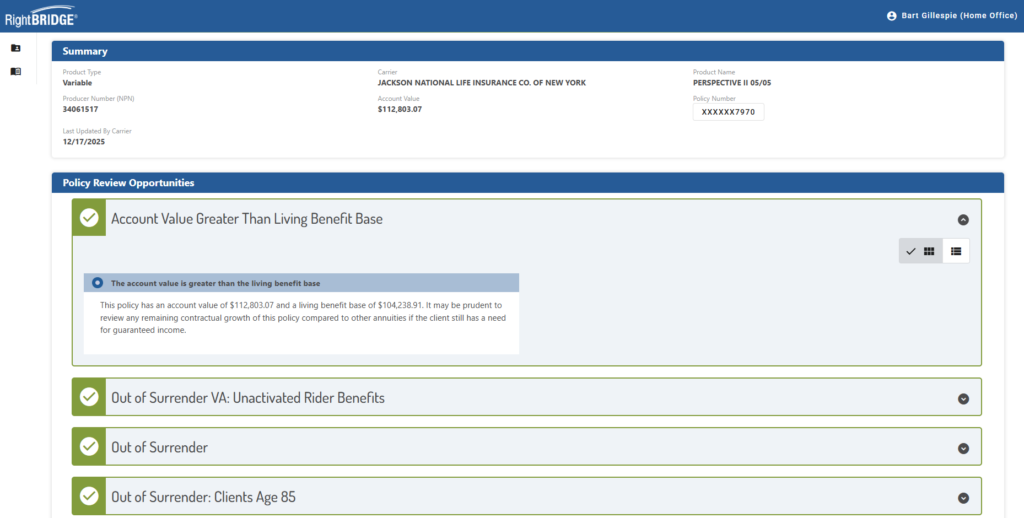

Annuity Book Management includes a library of “policy review opportunities” to flag in-force annuity policies meeting specific criteria, such as:

• Out of Surrender Period

• Within 60 days of CDSC End Date

• Missing Primary Beneficiary

• Variable Annuity Allocated to Fixed Accounts Only

• Account Value Greater than Living Benefit Base

• Annuity with Unused Benefits (benefits purchased but not yet activated)

• Firms can request additional filters for policy review opportunities, which will be reviewed for feasibility and general benefit for most customers. Updates will take place as part of scheduled releases.

• Customers may also configure parameters to adjust scoring and emphasis on each policy review scenario. Customers are responsible for their parameters.

Explanatory text, known as ReasonText®, can be provided for each flagged policy to assist users in understanding the reasons behind the policy review opportunities

Annuity Book Management is built with a concise feature set that standardizes analysis, scoring, role‑aligned access, and reporting—delivering auditable, prioritized opportunities without exposing configuration.

Directly ingests in‑force annuity data from DTCC PVF files and/or the DTCC IIEX API, normalizes it into a single system, and replaces fragmented carrier‑portal pulls and manual entry with authoritative, standardized policy data.

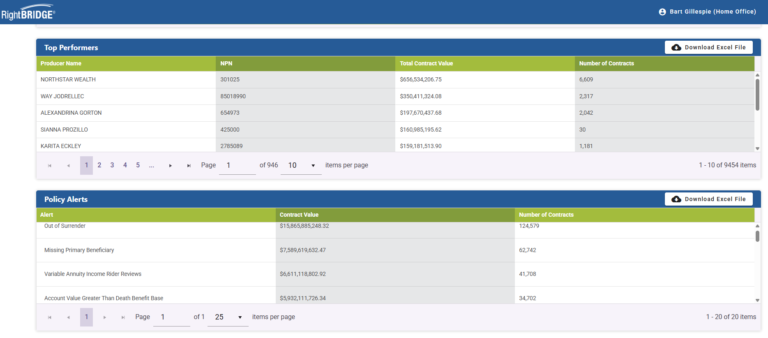

Runs automated contract reviews and applies firm‑level weights to produce composite scores, so prioritization is consistent across the organization and aligned to compliance and supervisory policies.

Generates clear, policy‑level “reasons why” for every surfaced opportunity, creating a printable audit trail from input data to recommendation—transparent decisioning without a black box.

Enforces role aligned visibility for home office, regions, managers, and financial professionals based on broker‑dealer hierarchy metadata, preserving low level access and clean reporting slices.

Filters instantly by: 1) alert type 2) carrier 3) product 4) financial professional 5) NPN 6) other key fields. It then exports results to accelerate investigations, documentation, and follow‑up workflows.

Surfaces book‑wide composition and trends alongside Top Policy Review Opportunities, making high‑value actions visible for supervisors and financial professionals and supporting executive oversight.