April 1st, 2024 | Scott Miller, Product Manager, CapitalROCK

Let’s start with a discussion about what income is available in retirement and what are the different funding sources, followed by a case study and an in-depth discussion of how Annuities can provide essential income during retirement.

In 1975 there were 311,094 total Pension Plans that filed returns. Of those 103,346 were Defined Benefit Plans representing 33.22% of total pension plans. In 2021 the most recent year that data exists there were 765,124 pension plans, of which 46,388 or 6.06% were Defined Benefit plans.

One of the many advantages of a Defined Benefit Plan is the payout options available. Typically, a plan will guarantee payments for life, life with a period certain, life with a cash refund, or joint with multiple percentage options for the survivor.

Some current retirees worked for an employer that offered a defined benefit pension plan. With the promise that if you work for 30 years and make $60,000 when you retire you will receive 60% of your ending salary, or some other similar scenario. In large most of these types of pensions have gone away unless you work for a governmental entity, Federal, State, City, School, or other public institution.

Advantages of a Defined Benefit Plan?

-

- Guaranteed monthly income upon retirement.

-

- Professionally managed money.

-

- Annual cost of living adjustments (COLA), are usually part of the benefit.

-

- The longer you work the greater your benefit.

-

- Most are entirely employer funded.

What if you don’t have a Defined Benefit Pension plan to rely on for income in your retirement years. Where can you get the money necessary to fund your 30 + years of retirement and how much do you need?

Retirement Needs

The average retirement income for U.S. adults 65 and older is $75,020. The median income for that age group is $50,290, according to data from the Census Bureau and Bureau of Labor Statistics. On a monthly basis, the average income for U.S. adults 65 and older is $6,252. The median monthly income is $4,191.

For most retirees, Social Security and (to a lesser degree) pensions are the two primary sources of regular income in retirement. You usually can collect these payments early—at age 62 for Social Security and sometimes as early as age 55 for a pension. (Schwab.com)

Retirement Funding Options

-

- Social Security

- 40.2% of older Americans, only receive income from Social Security during retirement.

- The max social security benefit in 2024 at full retirement age, (66 and 6 months) is $3,822.

- The average Social Security Benefit in 2024 is $1,907 per month.

-

- According to Bankrate the largest percentage of people, 27.3%, take Social Security at 62 and $1,288 per month. (See chart below for additional ages, percentages and payouts).

- Social Security

| Age | Number | Percentage | Average Benefit |

| 62 | 807,587 | 27.30% | $1,288 |

| 63 | 222,908 | 7.50% | $1,510 |

| 64 | 238,163 | 8.00% | $1,625 |

| 65 | 388,996 | 13.10% | $1,875 |

| 66 | 1,182,692 | 24.70% | $2,040 |

| 67 | 122,918 | 4.10% | $2,400 |

| 68 | 74,743 | 2.50% | $2,595 |

| 69 | 66,638 | 2.20% | $2,807 |

| 70-74 | 302,327 | 10.20% | $3,065 |

| 75+ | 6,317 | 0.20% | $1,185 |

-

- 401(k), 403(b), 457, IRA, Roth IRA, SEP IRA, etc.

- As of March 2024 – The average retirement savings for those 65 to 74 is $609,230 while the median household retirement savings is $200,000. (Source: Federal Reserve Board)

-

- According to a 2023 survey by Nerd Wallet 60% of Americans don’t have a retirement-specific account set up to fund their retirement needs.

- 401(k), 403(b), 457, IRA, Roth IRA, SEP IRA, etc.

-

- Investments (Mutual Funds, Equities, Bonds, CD’s, Real Estate, etc.)

-

- According to Bankrate the average American has less than $100,000 in non-retirement savings.

-

- Investments (Mutual Funds, Equities, Bonds, CD’s, Real Estate, etc.)

-

- Working during retirement years.

-

- If there isn’t enough income to fund full-retirement, an alternative is to engage in part-time employment. This may help supplement Social Security, Pension, Tax favored account withdrawals and savings. The average worker could earn $15,000 to $40,000 per year working part-time, depending on their experience level and profession, but in most instances, tis isn’t a permanent fix, since by the age of 75 or so, worker productivity, physical ability and cognitive functionality can start declining, making part-time employment less of an option.

-

- Working during retirement years.

Retirement Scenario

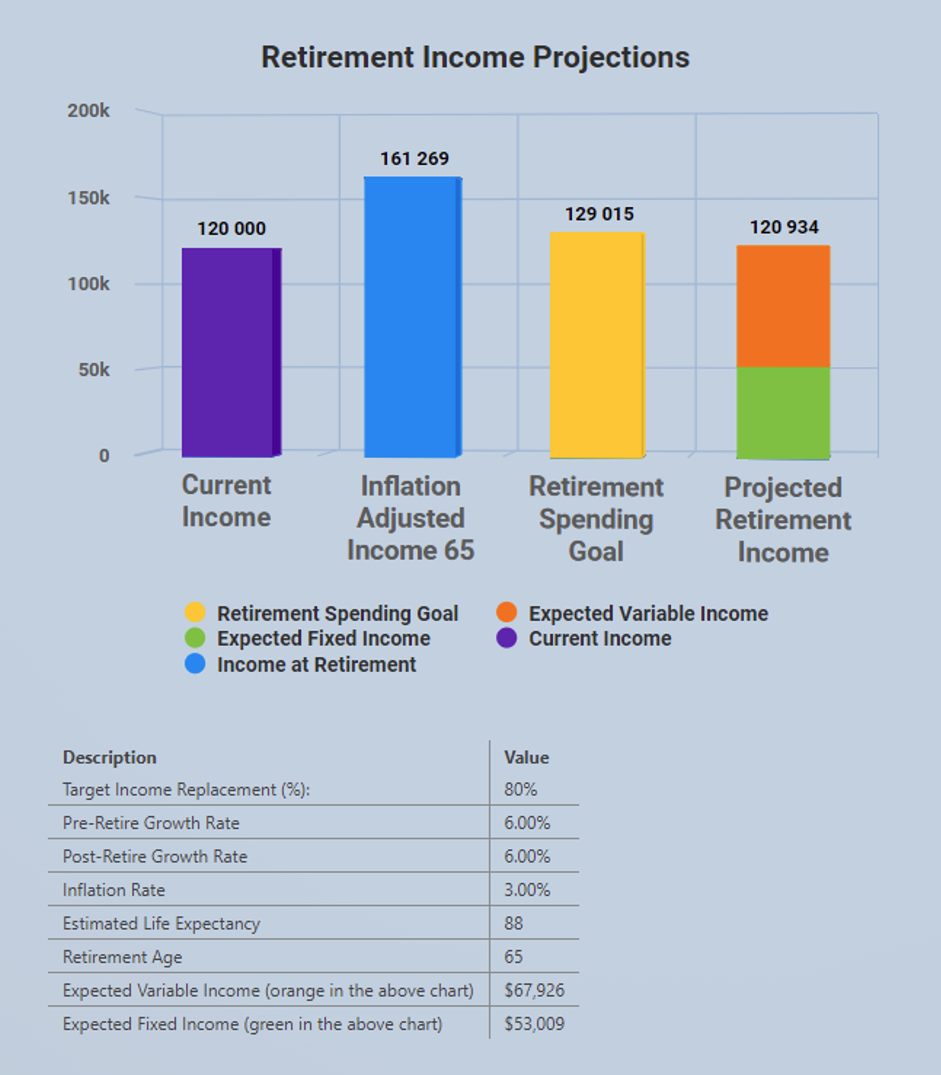

Let’s look at a typical retirement scenario for a couple who has saved, but doesn’t have a Defined Benefit Pension, and see how an annuity could help in meeting their retirement goal.

Jane and Jim Smith are:

-

- Currently 55.

-

- They plan on retiring at age 65.

-

- They each make $60,000 per year.

-

- They want to retire with 80% of their current income.

-

- Each is currently saving 20% of their income into a 401(k) including the Employer Match.

-

- They have a combined total of $400,000 in retirement savings.

-

- They plan on taking Social Security at age 65.

Based on these assumptions the following projections show their retirement situation at age 65.

Their inflation adjusted income at age 65 is $129,015. With Social Security and Retirement Savings, they would be able to achieve all but $8,000 with their current situation.

Let’s assume that the Smith’s take $200,000 of their $400,000 and purchase an annuity. With the following current assumptions:

-

- 10% Guaranteed Roll-up for 10 years

-

- Take lifetime income at age 65 with a 6.95% payout rate providing $27,800 of annual income.

This would boost their income for life by an additional $6,000 per year helping bridge the $8,000 per year gap. The annuity has the advantage of providing lifetime income as well, regardless of the investment performance or the longevity of the couple, they will get monthly checks as long as they are alive and can elect to reduce the payout, or even take a larger withdrawal amount if needed with some annuities (this can affect the payout amount in the future).

The annuity therefore addresses 2 issues and acts like the Defined Benefit Pension that they don’t have access to through their employers.

-

- They have a lifetime of guaranteed income.

-

- They can make up $6,000 of the $8,000 shortfall they are projecting.

But don’t annuities come with high fees and charges?

-

- Annuity fees are higher than a mutual fund, ETF, or some other investment instruments, but they also provide greater guarantees – lifetime income, you’re not going to run out of money if you live until you are 85, 90, 95 or even 100.

What about taxation on Annuities?

-

- Annuities provide tax deferral on growth until the payout begins, and then the payout percentage is prorated based on the payout, thus only part is taxable if it’s a non-qualified annuity.

-

- If it’s qualified money, 401(k), IRA, etc. The annual distributed amount is taxable, just like any other qualified retirement account.

Won’t we or our beneficiary’s’ lose access to the money if there’s an emergency, or if I die?

-

- Many annuities with living benefit riders offer access to take an additional distribution if needed (this may reduce future payments),

-

- Most offer joint and survivor benefits or leave the remaining balance to your beneficiaries.

-

- Some even have special provisions if nursing home or ADL requirements are met, providing for accelerated payments, double payments, or waivers of surrender or penalty fees for withdrawals.

What type of Annuities are available to help me achieve my retirement income goals:

-

- Deferred Income Annuity (DIA): Income annuities are designed to provide a guaranteed level of income based on the initial deposit and a guaranteed payout in a specified number of years in the future. The DIA is a very steady and predictable income source, but is very restrictive in the payout options and access to the money prior to income commencement, and little to no flexibility once income payments have begun.

-

- Fixed Annuity with a Benefit Rider: Typically, there is a guaranteed fixed rate tied to the annuity, with a rollup of the payout rate based on the number of years the annuity is held and the age that the annuity was purchased. The Fixed Annuity with a Living Benefit rider is very predictable, and the income is guaranteed for the life of the contract and during payout.

-

- Variable annuities (VA) are made up of separate accounts, which invest in a basket of fixed, equities, or bonds and allow the annuity owner/annuitant to allocate the deposit and contributions across the separate account/subaccounts. The owner/annuitant can invest the money in a manner as risk or risk adverse as they desire by allocating among the various subaccount/investment options. When income payments commence, the payouts can fluctuate on a prescribed basis, depending on the underlying investment performance of the subaccounts/investment options, or the payments can be locked in over the life of the owner/annuitant.

-

- Fixed Indexed Annuity (FIA) contracts have fixed and variable features. The investment performance is tied to an index such as the S&P 500, or NADAQ 100, with the provision that there are no negative returns realized. There is a limited upside as designated by a cap or participation rate. For example, the S&P 500 might return 27%, but there is a 7% cap, so the account would only realize a 7% gain. Conversely with an S&P 500 loss of 12% the account would see a 0% return.

-

- Registered Linked Indexed Annuities (RILA) are a hybrid between a VA and an FIA. They incorporate the index and separate account/subaccounts of a VA and the loss limiting factors of an FIA. With a RILA there are buffers, floors, and other crediting strategies. A buffer protects against a loss of a specified percentage. A 10% buffer S&P 500 index strategy means that no loss would be experienced if the S&P lost 7%, but if it loses 15%, the client will experience a 5% loss. A Floor of 10% means the client would take a loss of the first 10% but would be protected if the index dropped more than 10%. There are many other indexes employed and strategies used with RILA’s.

Each of these annuity types can be purchased with a Living Benefit Rider that guarantees a specified rollup or deferral credit rate and a guaranteed level of payout percentage based on attained or purchase age. The underlying investments during the accumulation phase can be fixed, indexed, invested in a separate account (mutual fund like), or invested in an index with guaranteed protections or limits on the amount of downside loss that can be experienced. Annuity investment options also offer differing upside potential based on the protection level desired.

An annuity is an excellent way to fund retirement, with its pension-like structure, professional money management, and the guarantee of lifetime income. There are hundreds of annuity and rider combinations that make the task of choosing the best annuity for your clients’ needs seem intimidating. The annuity selection process can be streamlined by using The Annuity Wizard. A tool available to financial professionals through their sponsoring agency. The Annuity Wizard uses a business rules engine to find the best fit annuity based on age, deferral period, risk tolerance, deposit amount, and guaranteed income, thus, taking the process from overwhelmingly complex to as simple as 10 minutes of client profiling.

The material contained in this communication is informational and general in nature. The material contained in this communication should not be relied upon or used without consulting appropriate legal or financial representatives to consider your specific circumstances. This communication was published on the date specified and may not include any changes in the topics, laws, rules, or regulations covered.