Artificial Intelligence (AI) is an umbrella term for many different technologies including machine learning, neural networks, expert systems and large language models (LLM). For many years RightBRIDGE has been using expert systems to provide a rules-based approach to provide firms with automated “guardrails” to adhere to regulatory requirements. Rule-bases provide a consistent and repeatable approach by applying consistent rules and parameters to reinforce compliance standards. From a compliance standpoint, a user must “show their work”. The ReasonText® provided by RightBRIDGE is used to describe the analysis and results.

CapitalROCK is introducing RightBRIDGE+ which includes additional functionality using large language models otherwise known as generative AI. RightBRIDGE+ uses generative AI to provide added functionality to supplement the battle tested rule-based system currently deployed in the RightBRIDGE solution. An important note, the large language model is only applied to the existing content within the 4 walls of the RightBRIDGE environment to limit the analysis to reliable reference material.

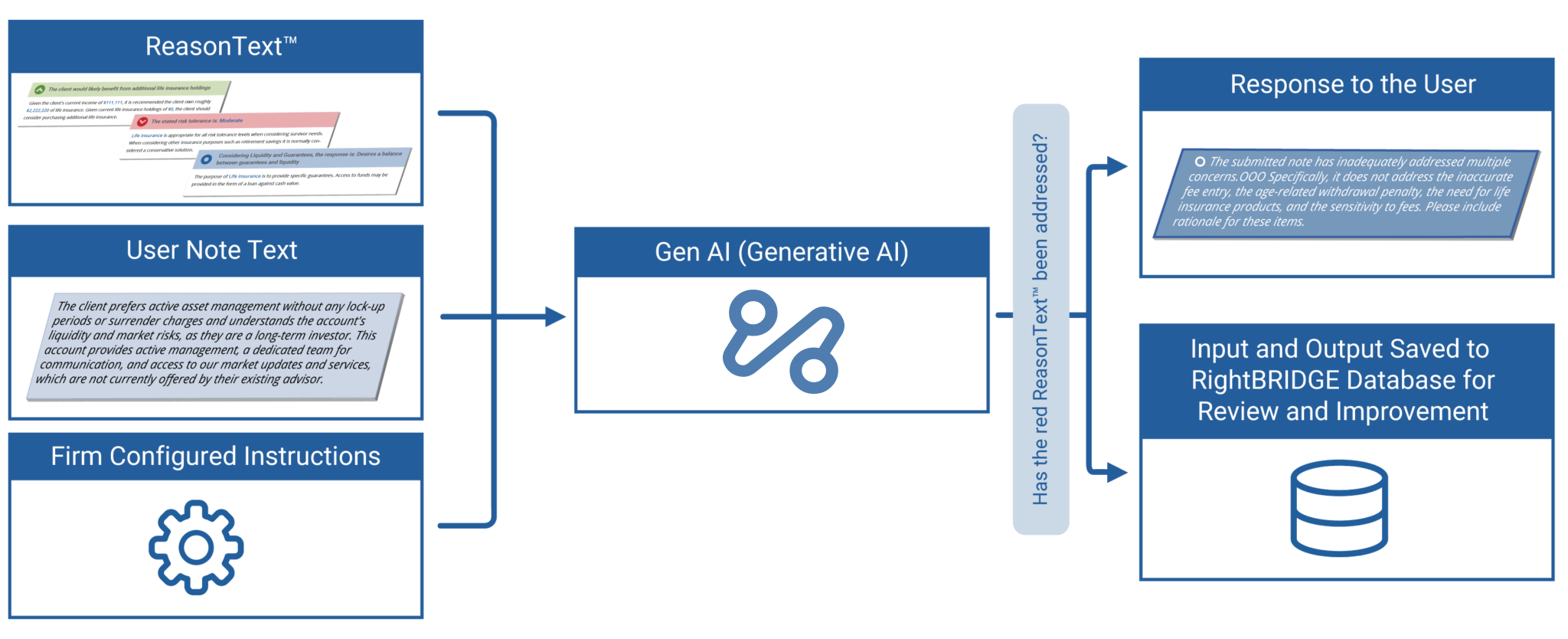

One of the largest causes of NIGOs is insufficient or inaccurate case notes provided by financial professionals documenting the details and recommendations of products for suitability and regulatory compliance requirements. The AI Notes Agent is designed to enhance the review process of submitted case notes written by the financial professional. The RightBRIDGE+ Notes Agent will analyze the financial professional’s note from the relevant RightBRIDGE application and the corresponding ReasonText® and provides specific direction on whether the note addresses the requirements of the case using a sandboxed generative AI (gen AI).

ReasonText® for a particular item is combined with the user note and the firm configured instructions (prompt) in the generative AI . The generative AI returns to the system a response that indicates what has been identified as missing in the note.

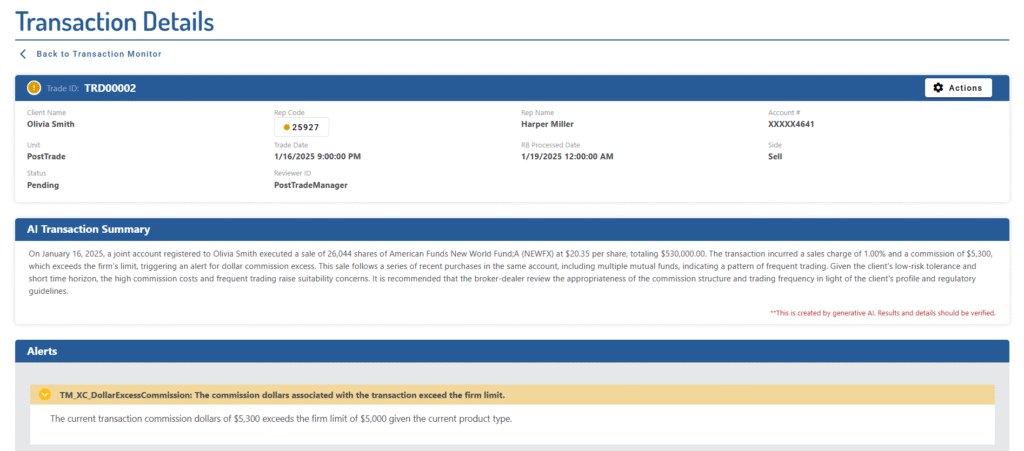

RightBRIDGE has implemented AI functionality using generative AI to summarize the case data down to a format that will provide users a simplified view of a case. Data and results including ReasonText® and scores are passed to the generative AI. A firm-configurable prompt is analyzed with the data. The resulting output can be formatted as a summary report or displayed on screen. The following is an actual summary generated by the AI solution. This sample is based on a report that is ~20 pages. Full-length RightBRIDGE reports are also transmitted with the Case Summary.

Patrick Childs is rolling over $300,000 from a 401k into an annuity. Patrick Childs has $680,000 in investable assets. Patrick desires a balance between guarantees and liquidity, would like to manage their own assets, and does not have a strong opinion regarding fees. The main purpose for the annuity purchase is for Income/Living Benefit Riders. The initial withdrawal is $22,275 annually, which lines up with Patrick desire for income through the purchase of this annuity. Patrick has a moderate aggressive risk tolerance. It is worth noting that the total cost of the proposed variable annuity will be 1.50% annually.

Sample paragraph

The RightBRIDGE Post-Transaction AI Summary uses generative AI to streamline and enhance the suitability review process. Powered by best-in-class models and designed to keep broker-dealer data securely siloed, it analyzes each transaction alongside triggered alerts, client suitability profiles, and firm-specific configurations. The result is a concise, 2–3 sentence summary that highlights key considerations and potential next steps—serving as an intelligent assistant to the principal and helping ensure that critical context is not only surfaced but thoughtfully addressed.

In RightBRIDGE, users currently enter information about administrative and investment fees for their customers’ plans, annuities, and accounts. The most reliable source for this information is often the customer’s plan, annuity, or account statements. However, because these statements vary widely in terminology and layout, financial professionals must interpret them manually, which can lead to frequent errors.

The new AI-powered document reading feature streamlines this process. Users can now upload documents—such as 401(k) plan statements, annuity statements, or account statements—directly into the RightBRIDGE application. The AI automatically reads and extracts key information, including names, holdings, fees, and other important details. Before the data is used, users can review and confirm the extracted information. Once confirmed, the relevant fields in RightBRIDGE are automatically populated. This intermediary review step ensures faster, more accurate data entry and reduces the risk of both human and AI errors.

How It Works

– The financial representative uploads the relevant documents into the application.

– The documents are processed by a large language model (LLM), which is prompted to extract the necessary information.

– The application presents the extracted data to the financial representative for review.

– The representative selects which data to use and edits any discrepancies (human-in-the-loop).

– The selected data is then used to populate the RightBRIDGE questionnaire.

This process improves efficiency and accuracy, making it easier for financial professionals to complete forms with confidence.