March 27th, 2024 | Hayden Galloway, Product Manager, CapitalROCK

Trends to follow for 2024

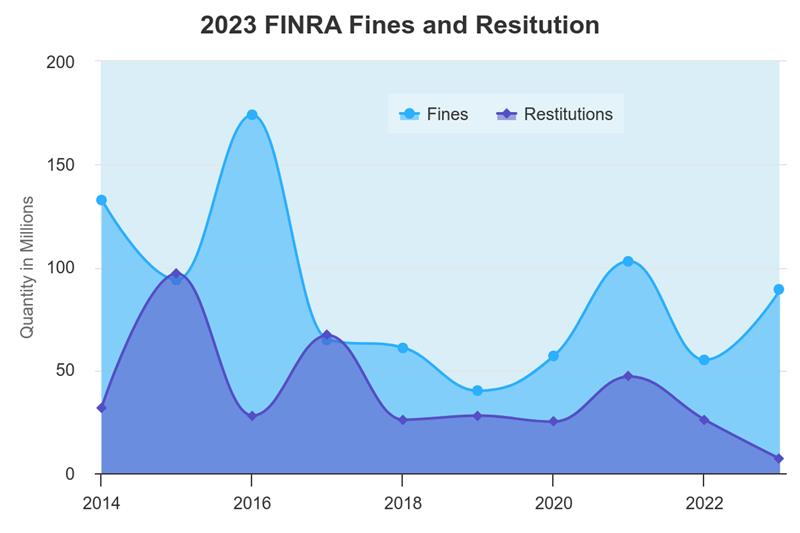

FINRA reported $89 million in fines in 2023. This is a 63% increase from 2022, in which FINRA reported $45.4 million in fines. Although one of the fines administered was $24 million, accounting for most of the year-to-year increase, the number of cases with fines also increased.

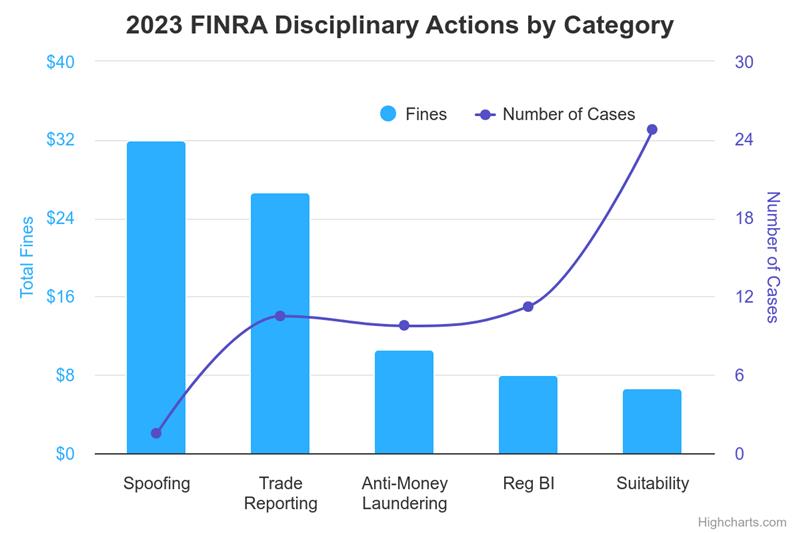

Eversheds Southerland released their yearly analysis of FINRA’s 2023 disciplinary actions [1]. The top five FINRA enforcement issues they found for 2023 include Spoofing, Trade Reporting, Anti-Money Laundering, Regulation Best Interest, and Suitability. Note that this is the first time that ‘Spoofing’ made their list.

Here are the details of the five enforcement issues, ranked by the total fines assessed in each category.

-

- Spoofing

Spoofing is when traders place orders that they do not intend to execute but hope that the perceived trades are significant enough to change the market supply/demand dynamics. The trader will then usually execute a smaller trade, benefiting from the spoof, and cancel the initial one. Two fines were given totaling $24 million (most of that was the one large fine).

- Spoofing

-

- Trade Reporting

Trade Reporting requires transmitting information like price, volume, the security involved, time of execution, and settlement date. There were 14 instances of enforcement of this type, totaling $20 million in fines.

- Trade Reporting

-

- Anti-Money Laundering

FINRA keeps a close watch to make sure illegally obtained funds are not introduced into the trading of securities by requiring firms to file their Suspicious Activity Reports. There were 13 cases of this type resulting in $8 million dollars in fines.

- Anti-Money Laundering

-

- Regulation Best Interest

Regulation Best Interest (Reg BI) is a relatively new regulation. The first fine was administered only two years ago. But seeing how the frequency of fines related to Reg BI is quickly increasing, it is likely going to continue to receive scrutiny. The norms for Reg BI are still being established. Firms comply by ensuring the customer receives all the disclosures associated with the transaction, meets the care obligation, identifies possible conflicts of interest, keeps records of the transactions, and updates their policies and procedures. There is a lot to scrutinize, and firms will have to be prepared for the increase in cases. There were 15 Reg BI fines administered in 2023 with $6 million in total fines.

- Regulation Best Interest

-

- Suitability

Suitability concerns the ability to confirm that an investment is appropriate considering the investor’s investment profile. FINRA outlines the requirements and concerns for suitability in FINRA Rule 2111. Reg BI elevated the standard of conduct for advisors above FINRA Rule 2111. When Reg BI was implemented in 2020, Rule 2111 was changed to match the same standard set by Reg BI. There were 33 suitability related fines in 2023 totaling $5 million.

- Suitability

What’s next in FINRA enforcement and guidance?

In their 2024 Regulatory Oversight Report, FINRA added new findings and effective practices to four areas: cryptocurrency, OTC quotations for fixed income securities, advertised volume, and the market access rule. [2]

-

- For cryptocurrency related assets, FINRA will allow broker dealers to operate as an Alternative Trading System (ATS), the agent in facilitating private placement, or be the custodian of these assets [3]. They emphasize the need for supervision over private placement recommendations, communicating the risk to the public, and ensuring that practices such as money laundering do not become an attraction for this developing asset class. See their complete list of considerations here, and their recent notice to increase crypto related exams here.

-

- Over-The-Counter (OTC) quotations are when broker-dealers submit a quote on a service other than a national securities exchange. Broker-dealers are required to find and review all public information related to issuer of the security, to comply with Exchange Act Rule 15c2-11 governing the OTC market.

-

- FINRA also updated details in their annual report relating to FINRA Rule 5210, the need for firms to carefully advertise their trading volume, so as to not inflate their actual numbers [4]. Firms will need to take additional care in documenting their current procedures to accurately advertise their trading volume.

-

- The Market Access Rule, formally known as Rule 15c3-5 under the Securities Exchange Act (1934), is designed to reduce market volatility and require broker-dealers to manage their risk. The rule requires firms to monitor how they extend credit and capital, and to document the controls they have, to monitor their risk.

Each of these topics are areas that FINRA chose to give new guidance and effective practices for broker-dealers, and thus could be areas of focus in 2024.

Restitution declined in 2023, but it is important to note that restitution enforced by FINRA has been declining for years. It is probably something they will look to understand more in the coming year, to verify that the decline is due to firms becoming better at self-regulating, making clients whole where necessary.

Best Interest Exams increased and are increasing infrequency. It was only in 2022 the first fine was enforced for best interest [5]. Best Interest Exam are not going away. Make sure your current policies and procedures are meeting the requirements for Reg BI with FINRA’s checklist for Reg BI and Form CRS. When updating your policies and procedures, implement a process to demonstrate your firm is not only aligned with Reg BI, but is acting in a way that is consistent with what you have documented.

No need to worry, FINRA is putting the $89 million of fines they collected in 2023 to good use. See a report of how they spent the fines from 2022. Prepare your compliance and surveillance programs so that you do not contribute during 2024.

References

1. https://www.eversheds-sutherland.com/en/united-states/insights/2023-finra-sanctions-study

2. https://www.finra.org/rules-guidance/guidance/reports/2024-finra-annual-regulatory-oversight-report

3. https://www.finra.org/rules-guidance/guidance/reports/2024-finra-annual-regulatory-oversight-report/crypto

4. https://www.finra.org/rules-guidance/guidance/reports/2024-finra-annual-regulatory-oversight-report/advertised-volume

5. https://www.reuters.com/legal/legalindustry/regulation-best-interest-sees-its-first-enforcement-action-2022-07-15/

The material contained in this communication is informational and general in nature. The material contained in this communication should not be relied upon or used without consulting appropriate legal or financial representatives to consider your specific circumstances. This communication was published on the date specified and may not include any changes in the topics, laws, rules, or regulations covered.