January 22nd, 2024 | Jared Lorenz, Product Manager, CapitalROCK

During a recent national compliance conference, I attended multiple sessions on reasonably available alternatives (RAAs). I found it interesting how, after a long presentation from the panelists on some high-level information regarding reasonably available alternatives, each Q&A session was bombarded by questions from confused firms wanting more details on what makes something a “reasonably available alternative”, how other firms are determining and documenting reasonably available alternatives for specific products, and wanting answers on how their firm should solve this problem. Each specific question was met with vague answers from firms and panelists who seemed to not want to speak definitively on what makes something a reasonably available alternative or revealing their process for determining reasonably available alternatives when making product recommendations.

It seemed like the confusion generated by the ambiguity of Regulation Best Interest (“Reg BI”) was ubiquitous.

Reasonably Available Alternatives: The Basics

On June 5th, 2019, the SEC released Reg BI to raise the standards of conduct for broker-dealers and their associated financial professionals when making a recommendation to retail customers. The regulation requires financial professionals to act in the “best interest” of the retail customer and includes a provision requiring financial professionals to consider reasonably available alternatives when making a recommendation.

The SEC emphasized that reasonably available alternatives are a crucial piece that sets Reg BI apart from previous regulations and said, reasonably available alternatives are “an inherent aspect of making a ‘best interest’ recommendation, and is a key enhancement over existing broker-dealer suitability obligations, which do not necessarily require a comparative assessment among such alternatives”1 (emphasis added).

In their most basic form, RAAs are a comparison of other high quality account types or products that are readily available and were considered in the process of selecting a recommendation that’s in the best interest of a retail customer.

Reasonably Available Alternatives: How to Choose Them and How Not to

Within RegBI, the SEC provides general guidance on how to choose (and how not to choose) reasonably available alternatives within their responses to broker-dealers:

1. How Not to Choose RAAs:

Don’t Evaluate ALL (or too many) Alternatives – Could you imagine evaluating all ~30,000 products for EACH recommendation made to a client?

-

- Considering every alternative product both inside and outside of a broker-dealer’s (“BDs”) offerings at every recommendation would be too long and time consuming.

- From the SEC: “A reasonable process would not need to consider every alternative that may exist (either outside the broker-dealer or on the broker-dealer’s platform) or to consider a greater number of alternatives than is necessary in order for the associated person to exercise reasonable diligence, care, and skill in providing a recommendation that complies with the Care Obligation.” 1

Don’t Think There’s One Best Product – Just like there’s not one universally enjoyed food, there’s not one best product for each retail customer.

-

- Despite a consistent high level of scrutiny, the SEC emphasizes time and time again that when choosing a recommendation and reasonably available alternatives, there is no “one best product”.

- From the SEC: “An evaluation of reasonably available alternatives does not require… broker-dealers to recommend one “best” product”1.

Don’t Ignore / Exclude Higher Cost Products – Sometimes there’s a reason for the higher cost – additional features or benefits cost extra

-

- The SEC acknowledges that there is value to a variety of products and product types, even the more expensive products, but reiterates that the cost of the product is only justified if it is in the best interest of the retail investor and matches the retail customer’s investment profile.

- From the SEC: “Our intent is not to discourage or otherwise limit the recommendation of products or investment strategies where a broker-dealer concludes that the recommendation is in the best interest of the retail customer… Under the Care Obligation, when a broker-dealer recommends a more expensive security or investment strategy over another reasonably available alternative offered by the broker-dealer, the broker dealer would need to have a reasonable basis to believe that the higher cost is justified” [1].

Don’t Choose the Lowest Cost without Considering Other Factors – Turns out smart cars aren’t for everyone?

- Despite the emphasis that cost should be one of the metrics used in every decision of best interest and in choosing all reasonably available alternatives, the SEC highlights that cost cannot be the only factor considered in determining what is right for a customer.

- From the SEC: “Recommendations of the “lowest cost” security or investment strategy, without consideration of other factors, could violate Regulation Best Interest.” [1]

2. How to Choose RAAs:

COST – Again and again, the SEC hammers into Reg BI, that although cost isn’t the end-all, be-all, it is a consideration that should always be considered within determining best interest and choosing reasonably available alternatives. This should include all costs associated with the product: upfront, ongoing, and deferred, whether potential or realized.

-

- From the SEC: “We believe that cost will always be relevant to a recommendation and accordingly should be a required consideration… This would include, for example, both costs associated with the purchase of the security, as well as any costs that may apply to the future sale or exchange of the security, such as deferred sales charges or liquidation cost.” [1]

Potential Risk – The SEC includes potential risk and potential rewards alongside cost as the major considerations in a best interest decision and in choosing reasonably available alternatives. These potential risks might consider potential qualitative risks that are inherent risks as part of the nature of the product and quantifiable risk based on historical performance of the product during different market conditions.

-

- From the SEC: “Potential risks and rewards – will always be a relevant factor that will bear on the return of the security or investment strategy involving securities.” [1]

Potential Rewards – The SEC doesn’t shy away from mentioning the importance of potential rewards in choosing a product in the best interest and reasonably available alternatives to a selected product. These potential rewards may be as a nature of the product (product features and benefits) and potential returns, as compared to the historical returns of the product.

Comparison – Within Reg BI, the SEC lays out that one of the major distinctions setting Reg BI apart from previous regulations is not only the suggestion of reasonably available alternatives, but the required comparison of reasonably available alternatives to recommendations in the best interest of the customer.

-

- From the SEC: “Reasonably available alternatives are… a key enhancement over existing broker-dealer suitability obligations, which do not necessarily require a comparative assessment among such alternatives.” [1]

Other Products Available Within the Same Platform – Regarding questions on how to consider reasonably available alternatives based on the variety of ways that broker-dealers handle their product shelves, the SEC mentioned that firms could create a consistent process for determining reasonably available alternatives when determining product recommendations in the best interest of the client.

-

- From the SEC: “Where a broker-dealer offers numerous products on its platform, a broker-dealer or an associated person could reasonably limit the universe of “reasonably available alternatives” if there is a reasonable process or methodology for limiting the scope of alternatives.” [1]

IT DEPENDS – One thing that’s consistent: the SEC doesn’t want to provide an exact formula for how broker-dealers should consider reasonably available alternatives and leaves it open to interpretation for broker-dealers to come up with a solution that best fits the needs of their customers.

How Could These Guidelines Be Applied to Reasonably Available Alternatives for Investment Products?

- Having a process for determining a limited set of reasonably available alternatives from the firm’s product shelf

- Ensuring that there are a multitude of options available to meet the needs of each retail customer, including higher cost products with additional features

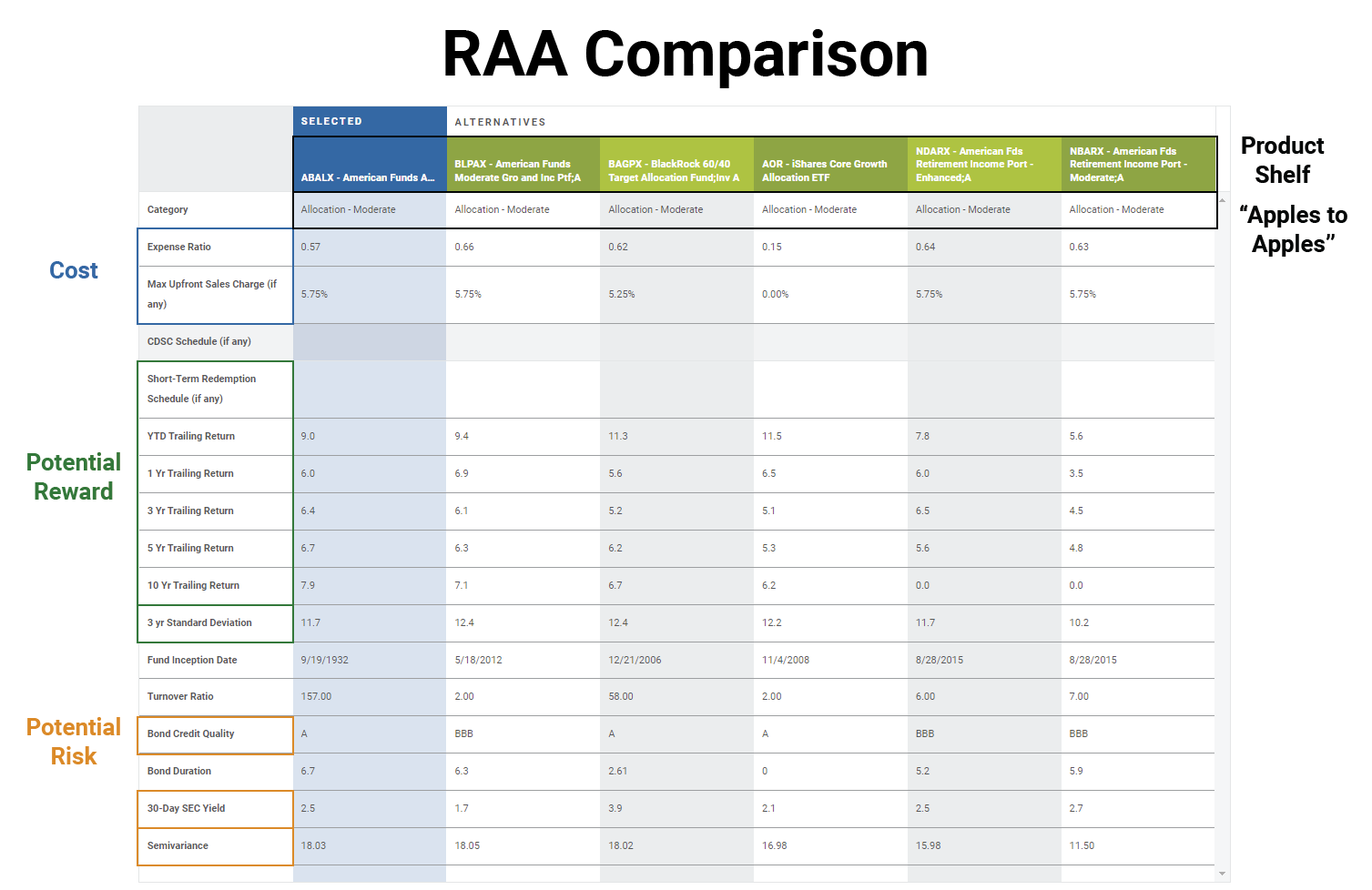

- Having a side-by-side comparison of product recommendations and reasonably available alternatives on the basis of cost, potential risks, and potential rewards. Though not explicitly required to document in every instance, consistent documentation could assist in clarifying the reason a recommendation is in the best interest of the customer.

- When comparing account types, we often see an approach of comparing “apples to oranges”, but once within an account type, we often see a comparison of “apples to apples”, comparing products of the same investment type (e.g. mutual funds to mutual funds) and with a similar investment objective or category (e.g. Large Cap Growth).

How RightBRIDGE’s Investment Wizard Helps with Reasonably Available Alternatives at the Investment Level

RightBRIDGE’s Investment Wizard is able to assist broker-dealers in generating reasonably available alternatives to recommendations made in the best interest of customers.

The Investment Wizard utilizes a process configured with a broker-dealer to generate RAAs according to the needs of a BD.

BDs are able to choose the number of RAAs to generate, determine which metrics to compare, have input on the methods used to choose reasonably available alternatives from the BD’s actual product shelf, and provide a side-by-side comparison of these reasonably available alternatives to a best interest recommendation on datapoints relating to cost, potential risk, and potential reward (among others).

In the image below, a side-by-side reasonably available alternative “apples to apples” comparison can be seen within the same category of mutual funds as the selected recommendation. Reasonably available alternatives from the BD’s product shelf can be seen compared on the basis of cost, potential risks, and potential rewards.

Overall, as laid out by the SEC in Reg BI, there is no one way to consider reasonably available alternatives for BDs. Though provided very general guidelines, the SEC leaves a lot up to interpretation on how a BD can best implement processes and procedures to best fit their firm.

Resources:

https://www.sec.gov/files/rules/final/2019/34-86031.pdf

The material contained in this communication is informational and general in nature. The material contained in this communication should not be relied upon or used without consulting appropriate legal or financial representatives to consider your specific circumstances. This communication was published on the date specified and may not include any changes in the topics, laws, rules, or regulations covered.